Analysis & Insights

The Impact of Increased Operational Complexity on Launching a New Private Equity Fund

10 Jun 2019

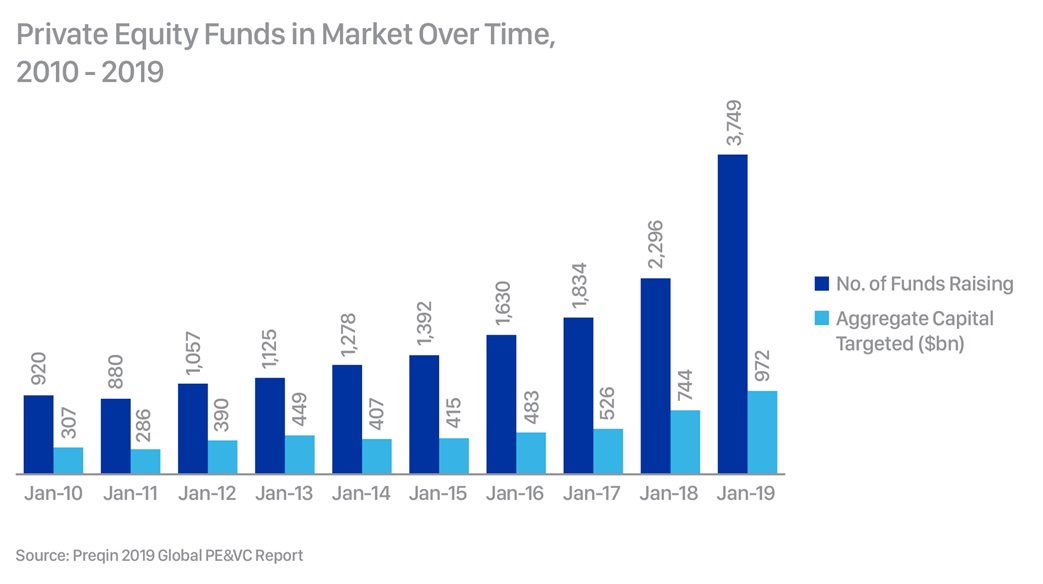

With more capital flowing to private equity, a number of established General Partners ("GPs") are looking to launch new funds. In addition, there has been a steady stream of entrepreneurial investment managers who are confident about opportunities in the space and are eager to set up first-time funds. However, doing so can be a daunting prospect and new challenges are emerging. Due to a rapidly evolving compliance landscape and growing regulatory scrutiny, coupled with increasing Limited Partner ("LP") demands, traditional practices for operating a private equity fund may no longer apply.

Launching and growing a private equity fund can be an arduous task. Significant time and resources are allocated to defining the investment strategy, ensuring the right team is in place, developing a plan for fundraising, establishing the appropriate legal structure and undergoing investor due-diligence. While these steps are necessary to lay the foundational elements for bringing a new fund to market, an equally important but often overlooked element of this process is creating a robust operational infrastructure. This is the linchpin of the fund’s operations and ensures not only a successful launch but ongoing effectiveness of the fund throughout its multi-year lifecycle.

Key elements of this process include:

- Establishment of Robust LP On-boarding Processes: With the continuing evolution of Anti-Money Laundering ("AML") regulations and Know Your Customer ("KYC") requirements globally, including recently enacted requirements for Cayman Islands domiciled closed-ended investment vehicles to be registered with the Cayman Islands Monetary Authority and comply with requisite regulations, there is a need to ensure mechanisms are in place for the management of the fund's legal obligations. This includes the collection of information and performance of AML / KYC in accordance with applicable jurisdictional legislation. Implementing a robust LP on-boarding process ensures adherence to regulations upfront, so that compliance risks are mitigated and time- consuming remediation is not required after capital is called.

- Establishment of Best of Breed Partnership Accounting Practices: Accounting for private equity investments requires a deep understanding of the fund's governing documents, such as limited partnership agreements and private placement memoranda. This can become more complicated as structures evolve to include co- investments and side agreements such as managed custody accounts. Funds can reduce operational risk and add value for LPs by leveraging third party resources that bring independence to the maintenance of books and records, including ensuring that valuations and expenses are applied in adherence to everything agreed between GPs and LPs. In addition, these resources bring specialised knowledge and expertise in complex allocations and incentive calculations, as well as experience monitoring the events that trigger waterfalls throughout the life cycle of each fund. Studies of SEC filings have noted that funds that utilise a third party administrator are also less likely to receive SEC sanctions or a qualified audit.

- Establish Regulatory Reporting and LP Screening Processes: Ongoing risk management and regulatory compliance have become key priorities for clients with regulators demanding greater transparency, enhanced reporting and investor oversight. Private equity GPs may be required to submit, maintain and produce a series of regulatory reports including Form PF and Annex IV filings on the firm’s assets, reconciliations and audit reports to demonstrate compliance with SEC custody requirements, and FATCA and CRS filings. In addition, they must manage various other compliance and due diligence requirements including ongoing KYC / AML verification

and the appointment of AML compliance officers in certain jurisdictions. Access to specialists in these areas can help ensure the required support for ensuring that the fund consistently discharges all of its regulatory obligations. - Establish a Strong Infrastructure around LP Relations: LPs have become increasingly sophisticated and are demanding greater transparency into their investments. GPs require solutions to facilitate connectivity and ongoing communication with LPs, ensuring they have access to current and historical documents including capital statements, call and distribution notices, quarterly and annual financial statements, performance history, market updates and newsletters. In addition, as LP requirements continually evolve, there may be a need for custom reports that GPs should be equipped to provide.

An ever evolving regulatory and investor landscape is putting more pressure than ever before on private equity GPs of all sizes to optimise their operational processes. GPs are grappling with how to effectively meet these increasingly onerous and rapidly changing requirements. While they have a number of factors to consider in how best to achieve this, access to expertise is key. Outsourcing certain business processes to an external service provider that has an established track record of operational excellence, innovative technology and seasoned professionals can yield significant benefits. Not only does outsourcing provide economies of scale, it can also significantly enhance credibility among LPs who are demanding more independence in fund operations. As a result, establishing sound operational practices will create access to larger pools of institutional capital.