Industry Updates

Pension Consolidation: Optimizing Scale and Maximizing Efficiency

25 Jan 2021

The US Retirement Crisis and the Benefit of Public Funds

Pensions for many Americans after World War II were the most critical component of the three traditional legs of retirement income, which also included private savings and Social Security. Today, however, guaranteed retirement programs like pensions have largely been eliminated for most Americans and neither private savings nor Social Security are likely to be able to make a comfortable and secure retirement possible. Last year, the median 401(k) for an investor at Vanguard aged 65 or older was less than US$60,000. The Social Security System is also under stress and, according to a 2020 report from the Social Security Board of Trustees, the program is currently facing a US$16.8 trillion shortfall. A permanent 25% reduction in all benefits starting in 2035 could be necessary to maintain the program's solvency if neither benefits are reduced nor contributions are increased before then.

Public pensions are one of the more effective means of providing stable retirement benefits for America's first responders, teachers and government workers. These retirement benefits, when covering a large pool of employees, can typically be provided by employers at a much lower cost than if the employees tried to acquire a similar level of retirement income on their own through commercial providers such as insurance or mutual fund companies. As a result, state and local governments are able to benefit from lower average salaries than they would bear for private sector employees and generally have an advantage in terms of hiring and retaining talented employees.

Whie generally stable and secure historically, public funds now face tremendous economic and political pressure. As central banks globally have lowered interest rates and elevated asset prices relative to historical levels, they have concurrently reduced the future expected returns for pension investments including stocks and bonds. Despite relatively strong performance since the 2008 financial crisis, the funded ratios of public pensions have not significantly improved.

In response to artificially low interest rates used by central banks to try to avoid recessions at all costs, pension plans have broadly reduced their future expected returns. The lower assumed future rates of return, however, negatively impact the expected growth of pension assets and, therefore, their funding ratios.

While extremely low central bank rates can be a catalyst for economic activity, there are also clear risks and economic costs associated with this approach. Ultra low rates fuel speculation and erode the traditionally safe returns of investment grade bonds. Negative interest rates in Europe have severely eroded the earnings and capital of their banking system. After 13 years, the European banking sector's market capitalization is still less than a third of its 2007 peak. Another consequence is extensive damage to long-term asset owners and lenders like pensions and banks.

Low funding ratios require larger contributions from already stretched state and local government budgets. The current budget crisis for many states and municipalities, however, could be even worse if they have to compete for employees on salary alone. Police agencies in particular are facing a crisis in hiring and retaining police officers. Pensions have long been a cornerstone in retaining officers and other valuable employees and it is, therefore, critical that these pension systems position themselves for long-term success.

In the past, states and municipalities could manage simple investment programs that could meet their needs and achieve sufficient returns from a portfolio made up primarily of stocks and bonds held in separately managed accounts or mutual funds for smaller programs. These portfolios often operated with only limited assistance from a professional advisor for asset allocation and manager selection decisions.

Today, public pensions still offer states and municipalities a better option for providing retirement benefits to their employees than other available solutions, but the programs face many challenges in the expected low return environment. This has driven these pension funds to allocate more capital to alternative strategies, which can diversify their portfolios and provide more stable rates of return to help meet their investment objectives. Access to these strategies, however, requires pension plans to have the necessary scale. Smaller plans often face a number of limitations in this respect, which can reduce their ability to deploy capital into beneficial alternative investments. These limitations include:

- Lack of access to top-tier managers;

- Inefficiencies in contracting and structuring;

- Fewer resources to conduct due diligence on complex diversifying strategies; and

- Limited bargaining power to demand lower fees in line with larger state plans.

Size Benefit Limitations

A comprehensive study by the Center for Retirement Research at Boston College of public pension plan returns over the period from 2001 to 2016 found that size alone was not the primary driver of better performance and that plans generating top-quartile returns were, on average, actually smaller than the average size of lower quartile return plans. The smaller size factor was driven by the three lower quartiles all having some exceptionally large members. Therefore, while larger plans can benefit from greater efficiencies and negotiating power in the deployment of capital, scale alone does not drive superior returns. Exceptionally large investment programs often face challenges in finding opportunities with sufficient capacity to enable them to deploy enough capital to have a significant impact on their overall returns.

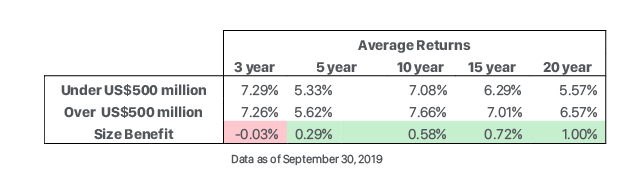

Plans that are too small also often have difficulty in performing as well as mid-sized and larger plans. An analysis of Texas pension plans found that the optimal size for a pension program is one with sufficient scale to deploy capital efficiently and access top tier managers. This study found that plans larger than US$500 million, on average, outperform plans with assets of less than US$500 million. This is particularly true over longer-term time horizons, which include periods of significant volatility. Pension plans with over US$500 million in assets have produced, on average, an additional 100 basis points in return per year over the past 20 years relative to their smaller peers.

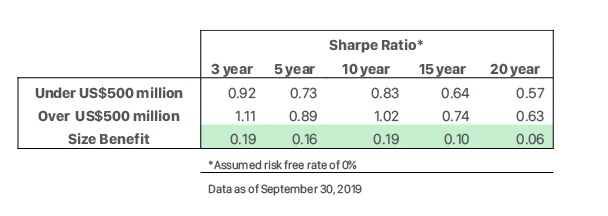

Similarly, the analysis found that the somewhat larger pension plans produce better risk adjusted returns over a number of time horizons as measured by the Sharpe ratio, which is the average return earned in excess of the risk-free rate per unit of volatility. Size alone, however, is not the driver of this outperformance and instead this is likely due to greater access to a broader range of opportunities and increased diversification. This analysis supports the idea that a plan size that enables adequate scale can be beneficial, but if plans are too large, their asset class exposures can become limited to index-like returns due to their extreme size.

*Source: Maples Group analysis of Texas pension plan data

Perhaps surprisingly, the Boston College Center for Retirement Research study also found that asset allocation was not a key differentiator of plan performance. Superior returns delivered by top-quartile plans were driven primarily by their asset class returns. Factors including manager selection, sub-asset allocations, structures and contracting terms typically drive asset class returns. Building a program's asset class exposure across a broad set of opportunities with limited overlap as well as finding top quality managers who have capacity in attractive investment opportunities are key factors in delivering superior asset class performance. These factors are particularly critical for returns in the alternative asset space, which has been seeing generally increasing allocations over the last few decades.

The Blueprint: An Overview of Consolidation

Healthy investment returns are vital to public employee pension plan survival, as investment income is required to compensate for cash-flow shortfalls. For many smaller plans, particularly those facing challenges related to underfunding, the case for increasing scale is clear and this can often best be affected via consolidation.

While consolidated structures may vary, one option as illustrated below, would be for the assets of individual plans to be consolidated into a single pooled vehicle, created to optimize returns without regard to the smaller plans other than to provide cash flows for distribution. The smaller programs will retain ownership of their liabilities and will have their proportional stake in the total fund available for distribution to meet liability payments. The pooled vehicle would be supported by an administrator responsible for maintaining an independent set of books and records, including data

management, investment and investor recordkeeping, fee calculations and customized portfolio analytics, among other functions, to ensure transparency and overall operational integrity.

This consolidation model maintains representation and accountability at the local levels, but creates investment programs of sufficient scale to access best of breed managers at competitive pricing while also potentially taking advantage of structuring solutions that could further reduce overall costs. It should also be reiterated that the consolidated programs should be of a size that is not too large to benefit from specific attractive investment opportunities and be relegated to index-like alternative investment returns.

Massachusetts provides a unique view into the benefits of consolidation. In 2007, Massachusetts mandated that poorly performing local pension plans consolidate assets under the Pension Reserves Investment Management Board ("PRIM"). Over the next decade, 26 of them moved half of their funds or more to the state investment trust. According to economic consulting firm, Analysis Group, by 2016, the 26 plans collectively gained about US$321 million, or about 7% of their total unfunded liability. Systems that switched funds to PRIM's Pension Reserves Investment Trust ("PRIT") gained annual gross returns of 8.9 basis points for every 10% of their assets transferred. These findings confirm that local systems in Massachusetts benefited substantially over the long term by transferring assets into PRIT.

The expectation is that other states with many funds could also benefit from consolidation. Illinois has more pension plans than all but one other state in the US, and some of the greatest levels of underfunding. The suburban and downstate police and fire pension plans are generally smaller than most plans nationwide and are falling behind in meeting their minimum required investment rates of return. Substantial additional contributions from employers and / or employees will be required or taxpayers may be left with the burden of making up for these lower investment returns, forcing many municipalities to rely on a never-ending cycle of increasing local property taxes or cutting services to meet their pension obligations.

A study by the Illinois Pension Consolidation Feasibility Task Force determined that their suburban and downstate police and fire plans underperformed their statewide municipal plan by an average of circa 2% per year over the last decade. Further analysis by the Illinois Department of Insurance looked at the investment returns of these plans against what those plans would have earned had they been pooled together into a larger system. The findings illustrated that consolidation would have resulted in a 112 to 201 basis-point increase in returns, which would have netted suburban and downstate police and fire plans an additional estimated US$160 million to US$288 million annually.

Based on these findings, the Task Force recommended to Illinois Governor J. B. Pritzker that the 649 suburban and downstate police and fire pension systems be consolidated into two investment programs, one for police and one for fire.

Benefits of Consolidation

Consolidation and the establishment of a shared investment platform can allow small plans to avail themselves of a number of the benefits realized by larger plans while also achieving the greatest value for employees, retirees and taxpayers.This pooling of assets allows for reduced costs through a single investment team for all plans and by affording the consolidated pool better negotiating power to drive lower management fees and performance fees. In addition, a consolidated approach can enhance operational efficiency by dramatically reducing the number of managers and other service providers (consultants, custodians, operational and technology service providers) across plans. Another benefit of consolidation lies in expanded investment and diversification opportunities. Not only does this approach enable more efficient manager research and due diligence and a streamlined allocation process, it also offers access to top-tier fund managers, greater choice in selecting investment vehicles and the ability to invest in more diversified, higher return assets to achieve better performance. Consolidation can also enhance effective governance. In addition to better negotiating power in terms of fees, a pooled vehicle may also receive special terms that reinforce transparency and alignment of interests. Furthermore, monitoring two consolidated plans rather than 649 individual plans would dramatically improve supervisory efficiency and oversight and can enable more in-depth review and audit without incurring substantial additional costs. Lastly, plans are afforded the support of customized, institutional-grade operations and technology solutions that provide best-of-breed independent administration and reporting. This can provide intuitive and actionable insight, which can result in an improved understanding of and engagement in the investment program by plan participants and fiduciaries.

Potential Challenges

While the benefits of consolidation can far outweigh any potential pitfalls, there will be certain challenges associated with a transition of this magnitude and complexity. These may include:

- Costs – Transitioning assets into a consolidated pool may come with initial upfront costs, though these would be substantially less than the upside from stronger investment returns over a matter of just a few years.

- Control – Plan sponsors may feel that their influence is being diluted, but can be reassured that assets and liabilities of local pension funds will remain under the ownership of each local pension board and each local pension board will continue to manage benefit distribution and determinations, including pension disability awards.

- Transition Period – Changes in the structure and governance of a consolidated pool will come with the usual "growing pains". In addition, there may be other challenges from the period of the consolidation plan becoming effective and the normal operations of a fully consolidated pool of assets. These will be presided over by an interim board during a finite transition period.

Ultimately, there is immense pressure on the financial health of the retirement system. Considering and closely monitoring any potential negative effects of consolidating plans is crucial to an effective transition.

A Roadmap for the Future

Pension consolidation can offer a number of positive outcomes, but it is critical to approach this process in a thoughtful and measured way. Some practical steps that should be considered to facilitate this process and ensure the most seamless transition possible are:

- Step 1: Assessment and planning – Once it has been established that asset pooling will benefit participant plans, the first steps are:

- Determining the optimal platform infrastructure to support the platform. This includes establishing the required governance structure, including the roles and responsibilities of the existing plans and the new platform, as well as determining the required functions and service providers to support the creation of the platform (e.g. fiduciaries, investment office, custodian, consultants, specialty service providers and legal advisors).

- Assessing the current asset allocation and determining what assets are currently held and where. This analysis requires strong data aggregation capabilities to be able to synthesize and harmonize data across all participant plans and to provide views into the investment portfolio, including current allocations, investments and liquidity terms as well as current investment fees. Leveraging this information, the future state investment policy should be created and agreed to by required stakeholders (e.g. the pooled vehicle board, investment office and consultant).

- Designing a project plan outlining the tasks, responsibilities and timeframes for the transition and implementation of the new platform.

- Step 2: Transition – The pooled vehicle board, investment office and consultants must effectuate the steps necessary to move toward the future state, which may include:

- Establishing the legal structures for pooling the assets;

- Determining how best to unitize the portfolio and accommodate subscriptions (contributions into the fund) and redemptions (distributions out of the fund);

- Selecting the initial investment manager(s) for each of the pools and negotiating the required investment agreements;

- Appointing the service providers for the ongoing operations of the pooled vehicle and investment pools, including the custodian, auditors and other providers as required (e.g. tax advisors, independent directors);

- Appointing the pool administrator to provide administration, data management and investment transparency, performance and risk reporting solutions for the investment office and the pension plans; and

- Transitioning the assets to the future state (i.e. selling the existing assets when possible and / or purchasing the new assets) in a way that ensures the portfolio will run smoothly during the migration and that the investment assets will be preserved throughout the transition.

- Step 3: Ongoing Operations – The assessment, planning and transition phases will build upon each other to create the future state operating model.

Practical Considerations

Consolidating investment programs will always have some challenges, but those challenges can be minimized with a strong focus on good data and liquidity management during the transition. Monitoring and aggregating information regarding plan holdings across constituent plans can provide valuable information on how to best transition those assets. Furthermore, understanding the starting point for all plans being consolidated provides a good baseline for measuring initial savings and the impact of allocation, structure and manager changes.

Prior to liquidating mutual funds and other holdings, there should be established liquid and low-cost index-type solutions for equity and fixed income allocations. This can enable the plan to broadly maintain the initial target allocations or risk profile for the program during the transition. Selling liquid assets and transferring cash to the newly created program might be an efficient way to speed up the build-out of the consolidated program. However, alternatives and illiquid holdings may need to be transferred in kind to the new consolidated program, providing the beginning allocations of the alternative asset classes for the plan.

Prior to transfer of those assets, a policy would need to be approved by the Board of the new program to determine the price at which assets would be transferred into the new consolidated program from its constituent members. The policy would need to address whether those assets would be transferred in at a discounted price as if they were being acquired by another investor or transferred in at a determined quarterly price provided by the fund's auditor or administrator. Those alternative assets should be evaluated for fit with the new program design and the high-quality investments with tier-one managers may be considered as long-term holdings. Those assets may also potentially warrant new relationship agreements with their managers while others, after evaluation, may require selling in the secondary market or be transferred into a legacy portfolio to wind down over time.

As the build out of alternative asset class exposures are considered, the program should evaluate the optimal structure for those holdings. As a new program with scale and significant assets to deploy, the plan has the opportunity to structure its investments based on its goals for manager relationships, direct investments, transparency and relationship pricing. Effective relationship agreements with top managers can significantly enhance the market insight and investment capabilities of the new investment program. They can also be used to obtain needed portfolio transparency, reduce overall portfolio costs and enhance manager alignment of interest with the consolidated investment program.

Staff, consultant and trustee responsibilities must be defined and clear program policies and objectives for the new portfolio must be determined. For example, is the goal of the new program simply to outperform a specific policy benchmark or is it to meet an assumed rate of return with the highest probability of success?

Carefully considering these factors, along with the governance structure that is built into the program from its inception, will provide the foundation for its long-term success. Adapting to a changing market environment and utilizing the best available tools and insights to build an optimal portfolio for the plan will be critical to realizing the vision of the program's founders.