Industry Updates

The Corporate Transparency Act – Implementation for Investment Funds and Structured Finance

04 Dec 2023

New beneficial ownership information ("BOI") disclosure requirements under the Corporate Transparency Act ("CTA") come into force on 1 January 2024 in respect of all non-exempt entities formed or registered to do business in the US.

Congress passed the CTA in January 2021, requiring the disclosure of a BOI Report[i] by in-scope entities to the US Treasury's Financial Crimes Enforcement Network ("FinCEN"), to bring the US generally into compliance with international terrorist financing and anti-money laundering standards. The CTA will have a significant impact on how most US and non-US entities are formed or registered to do business in the US, serving as a new policy tool to assist government authorities with law enforcement and prosecutorial efforts. Our previous articles on the CTA have outlined the detailed requirements and exemptions, alongside some frequently asked questions and practical issues for entity management under the new regulation. In this whitepaper, we examine some key issues for managers and structures from an investment funds and structured finance perspective, detailing the scope of compliance and action required under the CTA.

The Maples Group provides CTA services that can assist with compliance, including preparation and submission of BOI Report filings as required by the CTA, developing protocols and processes to support clients' entity formation process to ensure compliance with the CTA; and developing efficient workflows to support client CTA filings throughout the full lifecycle of their entities.

The following analysis is accurate as of October 2023 and does not constitute legal advice. Comprehensive discussions should be held with US counsel to determine the full extent of compliance for individual situations.

CTA Impact on Private Fund Managers and Advisors

While the CTA will have a relatively minimal direct impact on the market, managers may wish to consider its broader implications. By liaising with legal advisors, it can be determined if any CTA-related language is eligible for inclusion in transactional documents, offering documents or other marketing materials, to assist with informing all parties of the new legislation and (possible) disclosure requirements. Additionally, in-scope entities that qualify for an exemption do not proactively register for exemption with FinCEN, so for good corporate governance purposes, managers should consider how the exemptions are documented, i.e. by resolutions or other means.

Managers should review their general partner / manager and fund entities to identify exemptions or be prepared to disclose information on their Beneficial Owners[ii]. While many fund entities are likely to qualify for the Pooled Investment Vehicle Exemption[iii], it is important to note that subsidiaries of Pooled Investment Vehicles are not included in the CTA’s Subsidiary of Certain Exempt Entities Exemption[iv]. Therefore, certain special purpose vehicles (‘SPV’), alternative investment vehicles (“AIV”), blocker, splitter or aggregator entities not listed on the registered investment advisors’ SEC Form ADV may have to submit BOI Reports if they do not qualify for the pooled investment vehicle exemption (or any other exemption) on their own merits.

It is important to identify the many events that occur throughout the lifecycle of a private fund that may now have CTA reporting obligations. For example:

- Accepting investors into the funds (i.e.removal of the initial limited partner);

- Subscriptions and redemptions;

- Change in the board of directors;

- Change in Beneficial Owners’[v] personal information (name, residential address, expiration of government identification); or

- Entity no longer qualifies for pre-determined exemption.

Investment Funds

The following section examines some common investment fund scenarios and the impact of the CTA on the structure, tracking the entities which are in scope of the regulations.

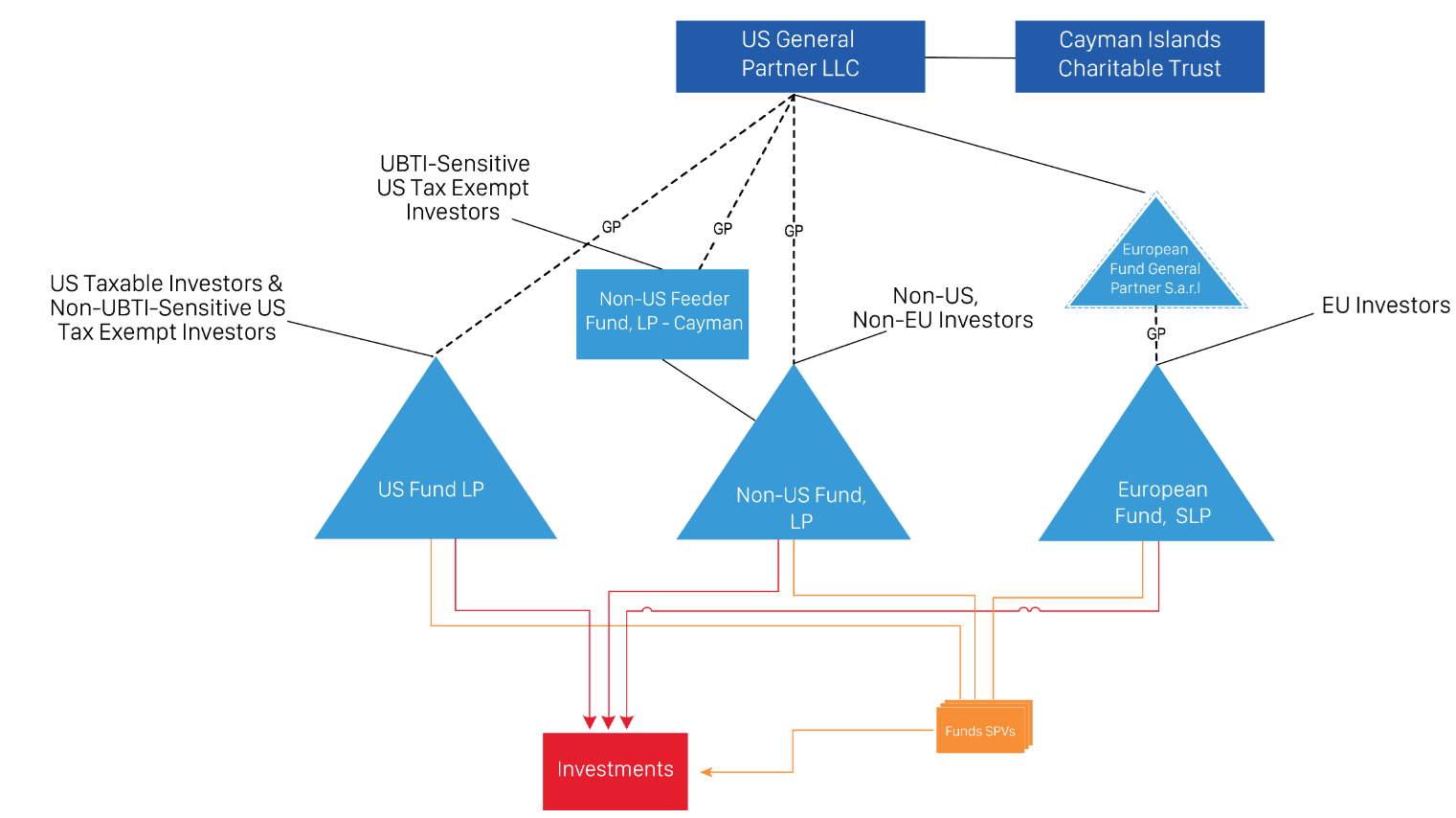

Private Equity Fund with Independent General Partner

Private equity sponsors establish multi-jurisdictional structures for a variety of reasons including, to attract a broad range of investors, account for the varying legal, regulatory and tax regimes and to optimise investment strategies.

Out of Scope Entities

Certain entities within the structure are not required to perform a CTA analysis since, per the rule, they are not US domiciled nor registered to do business in the US. This applies to other jurisdictionally and structurally similar vehicles used in certain private equity fund structures[1].

- Non-US Feeder Fund, LP: a Cayman Islands (or other non-US domiciled) fund formed for Unrelated Business Income Tax (“UBTI”) sensitive and US tax exempt investors.

- Non-US Fund, LP: a Cayman Islands (or other non-US domiciled) fund formed for non-US and non-EU investors.

- (Non-US) European Fund, SLP: EU (Luxembourg) based fund formed for EU investors.

- (Non-US) European Fund General Partner S.a.r.l: EU (Luxembourg) based entity formed to act as the general partner of European Fund, SLP.

Should any of the above entities register to do business in any US State by filing a document with a secretary of state then they will fall into the CTA filing obligations and must file a BOI Report within 30 calendar days of receiving evidence of the registration[2]; furthermore, should the entities utilise the Pooled Investment Vehicle Exemption[vi],, then they will be considered “Foreign Pooled Investment Vehicles”[vii] and a Special Reporting Rule[viii] applies and they will have to file a BOI Report disclosing the personal information of one controlling person.

Private Equity Fund with Independent General Partner Structure

In-Scope Entities

Entities that are formed or registered by filing a document with a secretary of state will have to perform a CTA analysis:

US General Partner LLC: a Delaware limited liability company (“LLC”) formed to act as the general partner of the US Fund LP, Non-US Fund LP, and Non-US Feeder Fund LP.

The US General Partner LLC will most likely meet the definition of a Reporting Company[ix], as it may not meet one of the CTA’s 23 exemptions and therefore may be required to file a BOI Report[x] to FinCEN.

The US General Partner LLC will need to obtain and disclose the requisite information on itself and the personal identifying information for the following:

- The individual who files the formation document with the secretary of state or similar office under the law of a state, territory or tribe on behalf of the US General Partner LLC, and the individual who is primarily responsible for directing or controlling the filing if more than one individual is involved (together, the “Company Applicants”)[3];

- All individuals with Substantial Control[xi] (i.e.directors, managers and / or senior officers) of the US General Partner LLC; and

- All individuals who, directly or indirectly, own or control 25% or more of the Ownership Interest[xii] of the US General Partner LLC.

To identify its Ownership Interest, the US General Partner LLC will look to its sole member, often a Cayman Islands entity licensed to act as trustee in order to hold its membership interests on the terms of a declaration of trust for the benefit of certain charities. As such, the US General Partner LLC may be required to disclose information on the individuals with authority to dispose of the trust’s assets such as the trustee.

To the extent the general partner is a subsidiary of the investment advisor, it will have to identify an exemption on its own merits or file a BOI Report[xiii] to FinCEN.

The US General Partner LLC will be required to file any updated BOI Reports[xiv] with FinCEN pursuant to the ongoing disclosure requirements of the CTA.

US Fund LP: a Delaware limited partnership formed to serve as an investment fund for US taxable investors & non-UBTI sensitive US tax exempt Investors. The US Fund LP is most likely exempt from being a Reporting Company[xv] under the Pooled Investment Vehicle exemption.

The CTA does not require exempted Reporting Companies to file for the exemptions; the US Fund LP should consider how this exemption is documented and tracked for governance purposes.

If a US Fund LP does not qualify for an exemption, they should consider filing a BOI Report with FinCEN similar to the US General Partner LLC.

US Alternative Investment Vehicles, Blockers / Splitters, Aggregators Vehicles (together, the “Fund SPVs”) – Throughout the lifecycle of a fund many AIVs, blockers, splitters, aggregators and other SPVs are formed as the fund deploys capital, offer co-investment opportunities, segregate assets, etc.

Each Fund SPV must perform a CTA analysis to determine its CTA filing obligations based on its own merits. Subsidiaries of US business entities that fall under the Pooled Investment Vehicles exemption are not exempt from the definition of Reporting Company[xvi].

This analysis should be considered at or prior to formation to ensure compliance with the CTA’s filing deadlines.

If the Fund SPVs do not qualify for an exemption, filing a BOI Report[xvii] with FINCEN should be considered. The requisite information includes:

- The Company Applicants;

- All individuals with Substantial Control[xviii] (i.e., directors, managers and/or senior officers) of the Fund SPVs; and

- All individuals who, directly or indirectly, own or control 25% or more of the Ownership Interest[xix] of the respective Fund SPV.

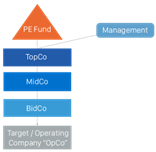

Acquisition Structure

While the exact structure for an acquisition will generally differ based on the bespoke legal and tax objectives, tiered debt and equity acquisition structures involving a Topco (top holding company), Midco (intermediate financing vehicle) and Bidco (bid vehicle) are a common example.

Acquisition Structure

Private Equity Fund – US Entity – Same analysis as US Fund LP (above). Most likely exempt under the Pooled Investment Vehicle exemption.

TopCo – US Entity (the Top Company) – refers to the top-level holding company that is formed by the private equity fund to pool the equity amongst the fund(s) and management to facilitate the acquisition and control of portfolio companies. It acts as the ultimate parent company for the target company / subsidiaries.

MidCo – US Entity (the Mid Company) – refers to an intermediate financing vehicle that sits between the TopCo and the BidCo. There may be more than one MidCo in many commonly used structures. The MidCo is typically wholly owned by the TopCo.

BidCo – US Entity (the Bid Company) – is the entity formed by the private equity fund specifically for the purpose of making the acquisition. The BidCo is typically wholly owned by the MidCo.

TopCo, MidCo and BidCo entities will most likely meet the definition of a Reporting Company[xx] as they may not meet one of the 23 exemptions, and therefore may be required to file BOI Reports[xxi] to FinCEN.

The TopCo, MidCo and BidCo will need to obtain and disclose the requisite information on itself and the personal identifying information for the following:

- The Company Applicants; and

- All individuals with Substantial Control (i.e., directors, managers and/or senior officers) of the TopCo, MidCo or BidCo, respectively; and

- All individuals who, directly or indirectly, own or control 25% or more of the Ownership Interest of the TopCo.

With respect to the Ownership Interest in the TopCo, MidCo, or BidCo, a Special Reporting Rule[xxii] would apply to any individuals who are Beneficial Owners of TopCo, MidCo or BidCo solely through their Ownership Interests in the exempt Private Equity Fund. The individuals would not be required to disclose their BOI to FinCEN. Instead, the TopCo, MidCo and BidCo would report the name of the exempted Private Equity Fund on their BOI Report[xxiii].

OpCo – US Entity (the Target / Operating Company) – is the portfolio company which the private equity fund is acquiring. They are typically existing businesses that the fund aims to improve and grow through operational and strategic initiatives. It will be in scope of the CTA and may fall into the Large Operating Company Exemption[xxiv], and therefore may not be required to file a BOI Report to FinCEN. To the extent the OpCo does not qualify for an exemption, it may meet the definition of a Reporting Company and should consider filing a BOI Report with FinCEN.

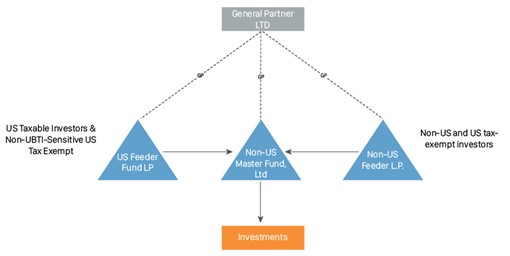

Cayman Master / Feeder Structure

Private equity sponsors establish master-feeder funds structures in order to pool US taxable, US tax exempt and non-US investors into separate vehicles in order to invest into a master fund that will, in turn, invest the capital on behalf of the feeder funds’ investors.

Out of Scope Entities

Non-US Master Fund, Ltd – (“Master Fund”) a Cayman Islands exempted company formed to serve as the investment fund to invest the capital contributed by the Non-US Feeder Fund and US Feeder Fund. It is out of scope and not required to perform a CTA analysis since, per the rule, it is not US domiciled nor registered to do business in the US.

Non-US Feeder LP – (“Non-US Feeder Fund”) a Cayman Islands exempted limited partnership formed to serve as a feeder fund for non-US and US tax-exempt investors will invest directly into the Non-US Master Fund, Ltd. It is not required to perform a CTA analysis since, per the rule, it is not US domiciled nor registered to do business in the US.

In Scope Entities

US Feeder Fund LP – (“US Feeder Fund”) Delaware limited partnership formed to serve as feeder fund for US taxable investors & non-UBTI-sensitive US tax exempt investors to invest into the Non-US Master Fund, Ltd.

An analysis must be conducted whether the US Feeder Fund LP is exempt from Reporting Company[xxv] obligations under the Pooled Investment Vehicle exemption.

If exempt, the CTA does not require exempted Reporting Companies to file for the exemptions; the US Feeder Fund LP should consider how this exemption is documented and tracked for governance purposes.

If a US Feeder Fund LP does not qualify for an exemption, they should consider filing a BOI Report with FinCEN. The requisite information includes:

- The Company Applicants;

- All individuals with Substantial Control (i.e., directors, managers and/or senior officers) of the US General Partner Ltd; and

- All individuals who, directly or indirectly, own or control 25% or more of the Ownership Interest of the US Feeder Fund LP.

General Partner Ltd - a Cayman Islands exempted company formed to serve as the general partner of the Master and Feeder Funds, it is not required to perform its own CTA analysis since, per the rule, it is not a US domiciled entity nor registered to do business in the US.

However, to the extent the US Feeder Fund LP is determined to have CTA filing obligations, it is likely the directors and senior officers of the General Partner Ltd will have to provide their BOI as part of the US Feeder Fund LP’s BOI Report.

Cayman Master / US Feeder Structure

Structured Finance

The following section examines a number of common structured finance scenarios and the impact of the CTA, tracking the entities which are in scope of the regulations.

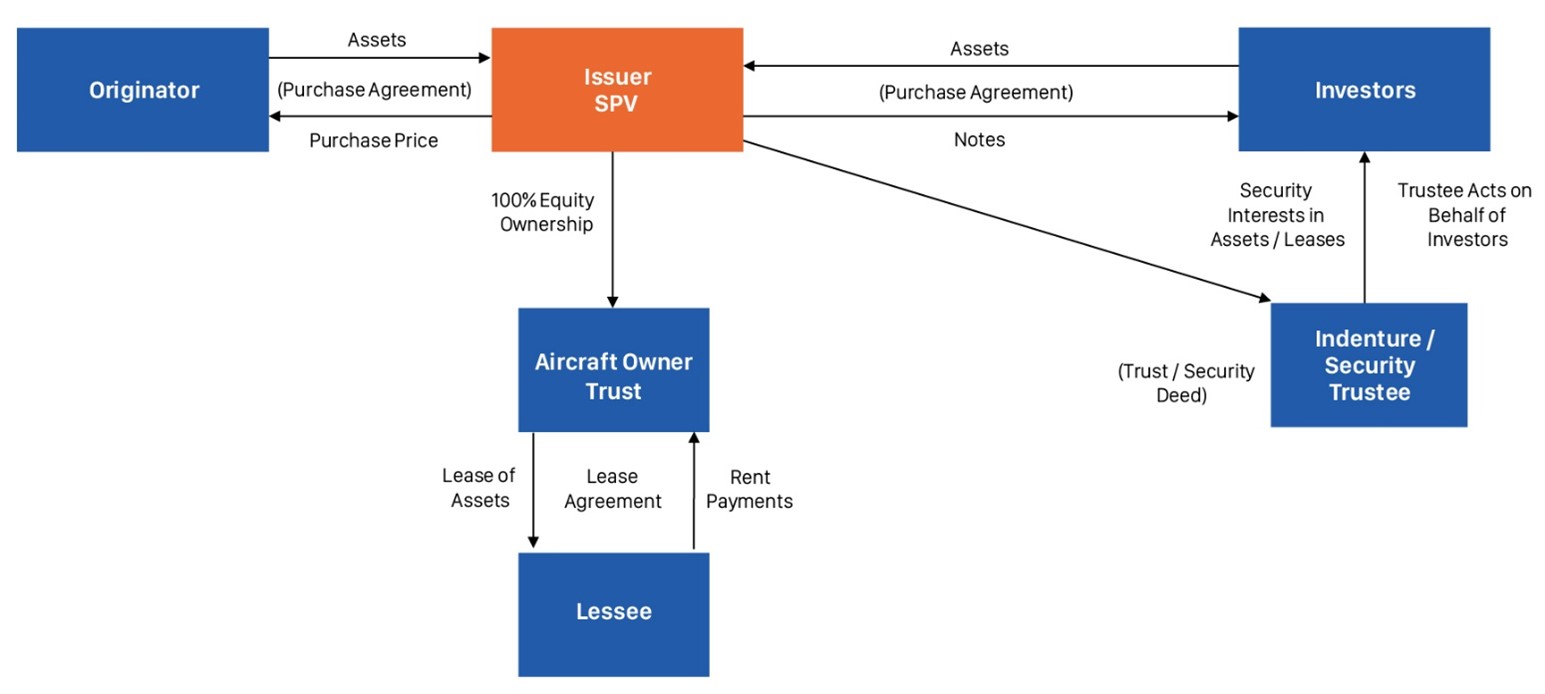

Asset Finance - Aviation Structure

Asset finance transactions are regularly used to finance high value hard assets and typically feature a lease mechanism to generate a stream of income for investors. In the aviation sector, initial upfront financing to acquire an aircraft can be difficult and expensive to arrange for airlines due to cost of external financing and available cashflows. Airlines may lack sufficient cash surplus to finance their plans for fleet renewal and as such the cost of financing the purchase of new aircraft is often prohibitive. As an alternative, airlines utilise asset financing structures.

In a typical Aviation Structure, an airline executes an aircraft purchase agreement with a manufacturer and the airline seeks financing from a lender / arranger. An off-balance sheet special purpose vehicle ("Issuer SPV") is established to facilitate the aircraft purchase whereby the SPV borrows funds to purchase of the aircraft. Common law trusts (“Aircraft Owner Trusts”) are often established to take title to aircraft at delivery and lease the aircraft to the airline / operator.

Aviation Structure

Out of Scope Entities

For the purpose of this analysis, we will assume the lender / arranger, manufacturer and airline are either out of scope of the CTA because they are not a US business entity or qualify for one of the 23 exemptions; however, each of these parties will be responsible for completing its own analysis with respect to its CTA filing obligations.

Aircraft Owner Trusts

The Aircraft Owner Trusts are the named owners of the aircraft and are typically structured as common law trusts. Unlike statutory trusts, common law trusts are based on private contracts and are not formed by filing a document with a Secretary of State, so the Aircraft Owner Trusts will not be in scope of the CTA.

In Scope Entities

Issuer SPV

The Issuer SPV is typically structured as a Delaware LLC. The Issuer SPV will be in scope of the CTA since it is formed by filing a document with the Secretary of State of Delaware and will likely not fall into one of the 23 exemptions. It may therefore be required to file a BOI Report to FinCEN.

The Issuer SPV will need to obtain and disclose the requisite personal identifying information for the following individuals:

- The Company Applicants;

- All individuals with Substantial Control (i.e., directors, managers and/or senior officers) of the Issuer SPV; and

- All individuals who, directly or indirectly, own or control 25% or more of the Ownership Interest of the Issuer SPV.

To identify its Ownership Interest, the Issuer SPV must look through to the Ownership Interest of its sole member, typically an investment fund where no individual owns or controls more the 25% of the ownership. Where any individual, directly or indirectly owns or controls not less than 25% of the Ownership Interests of the entity, the Issuer SPV will have to provide its BOI to FinCEN in the BOI Report.

Securitisation

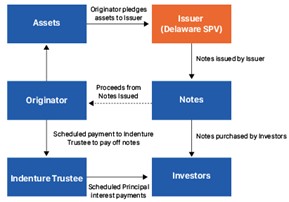

A securitisation pools various types of contractual debt (or other non-debt assets which generate receivables) and repackages them into interest-bearing securities sold to investors. Investors are repaid from the principal and interest cash flows collected from the underlying debt and redistributed through the capital structure of the new financing. The typical securitisation has a company or financial institution (the 'Originator') selling the contractual debt to a special purpose vehicle issuer (the 'Issuer').

The Issuer creates tradable securities which are sold to investors. Securitisations allow financial institutions and corporations to find a new source of funding and reduces their borrowing cost. Securitisations can cover a broad range of asset classes and structures. The following is an analysis of a basic securitisation structure.

Securitisation Structure

Out of Scope Entities

For the purpose of this analysis, we assume the Originator, Bank / Lender, Indenture Trustee, Noteholders and other deal parties common in many securitisation structures are either out of scope of the CTA because they were not formed or registered to do business in the US by filing a document with a secretary of state or similar office or qualify for one of the 23 exemptions. Each entity will be responsible for completing its own analysis with respect to CTA filing obligations.

In Scope Entities

Issuer SPV

The Issuer is typically structured as an LLC or Delaware statutory trust and issues the notes to the Noteholders. The Issuer will be in scope of the CTA since it is formed by filing a document with the secretary of state or similar office of Delaware and likely will not fall into one of the 23 exemptions, so therefore may be required to file a BOI Report to FinCEN.

The Issuer will need to obtain and disclose the requisite personal identifying information for the following individuals:

- The Company Applicants;

- All individuals with Substantial Control (i.e., directors, managers and/or senior officers) of the Issuer; and

- All individuals who, directly or indirectly, own or control 25% percent or more of the Ownership Interest of the Issuer.

To identify its Ownership Interest, the Issuer will have to look through to the ownership interest of its sole member. In most commonly used orphan structures, the Share Trustee holds the membership interest of the Issuer on trust, so the Issuer will be required to disclose information on the individuals with authority to dispose of the trust’s assets such as the trustee.

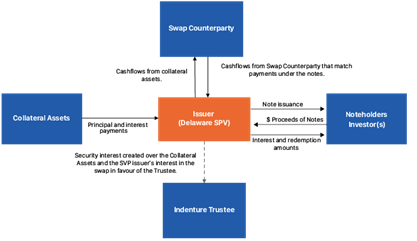

Repack

Repack or Repackaging is a structured finance transaction that allows banks to create bespoke investments for clients. A bankruptcy remote special purpose vehicle (“Issuer") issues one or more debt instruments (notes, bonds, warrants) that are funded by one or more underlying debt or equity securities the issuer has acquired. Cash flows from the underlying security go through a swap counterparty, creating a new cash flow in line with investor requirements.

Repack Structure

Out of Scope Entities

For the purpose of this analysis, we assume the Swap Counterparty, Indenture Trustee, Noteholders and other deal parties common in many repack structures are either out of scope of the CTA because they were not formed or registered to do business in the US by filing a document with a secretary of state or similar office or qualify for one of the 23 exemptions. Each entity will be responsible for completing its own analysis with respect to CTA filing obligations.

In Scope Entities

The Repack Issuer SPV LLC (typically a Delaware LLC) will be in scope of the CTA and will have to determine if it qualifies for the Pooled Investment Vehicle exemption or other exemptions.

To the extent the Repack Issuer SPV LLC does not qualify for an exemption, it may meet the definition of a Reporting Company and be required to file a BOI Report to FinCEN.

The Repack Issuer SPV LLC will need to obtain and disclose the requisite personal identifying information for the following individuals:

- The Company Applicants;

- All individuals with Substantial Control (i.e., directors, managers and/or senior officers) of the Repack Issuer SPV LLC; and

- All individuals who, directly or indirectly, own or control 25% or more of the Ownership Interest of the Repack Issuer SPV LLC.

The Share Trustee holds the membership interest of the Repack Issuer SPV LLC on trust, so the CLO Co-Issuer SPV may be required to disclose information on the individuals with authority to dispose of the trust’s assets such as the trustee. The Repack Issuer SPV LLC will be required to file any updated BOI Reports with FinCEN pursuant to the ongoing disclosure requirements of the CTA.

CTA Implementation - Key Next Steps

- Determine the entities in scope, the applicability of any exemptions and the implications and actions required in respect of each.

- Determine who qualifies as the Company Applicants and Beneficial Owners, given the CTA’s broad definitions.

- Consider updating entity formation processes prior to 1 January 2024, in order to classify properly when entities fall into an exemption or file a BOI Report.

- Consider evaluating ongoing entity management processes and whether they are sufficient to comply with the CTA’s ongoing reporting requirements.

The Maples Group

The Maples Group is well placed to assist clients with the preparation and submission of the beneficial ownership information report filings required by the US Corporate Transparency Act. Our Delaware office is long established and our expert team, specialising in US entity management, has vast experience with the US corporate environment, as well as all state and federal filing requirements.

We have intimate knowledge of similar beneficial ownership regimes around the world, using well established and market tested procedures to manage the vast numbers of filings potentially required by the CTA. In addition to preparing and submitting BOI Report filings, as required by the CTA, our team can develop protocols and processes to support clients' entity formation processes, to ensure compliance with the CTA and develop efficient workflows to support client CTA filings throughout the full lifecycle of their entities.

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

[1] Typically, non-US private equity fund entities would not be registered to do business in the US, but to the extent that is not the case the analysis / classification for CTA purposes may, of course, be different.

[2] On 28 September 2023, FinCEN proposed an amendment to the BOI reporting rule that would extend that filing deadline from 30 days to 90 days for entities created or registered on or after January 1, 2024, and before January 1, 2025.

[3] A Reporting Company is not required to report its Company Applicant if it was created or first registered in the US before 1 January 2024.

Appendix

Corporate Transparency Act Definitions

This information is accurate as of 31 October 2023 and does not constitute legal advice. Comprehensive discussions should be held with US counsel to determine the full extent of CTA compliance.

[i] BOI Report – The report submitted to FinCEN by a Reporting Company including specific pieces of information about the Reporting Company, its Beneficial Owners, and, for Reporting Companies formed or first registered in the US on or after 1 January 2024, its Company Applicants.

[ii] Beneficial Owner – any individual who meets at least one of two criteria: (1) Exercising Substantial Control over the Reporting Company; or (2) owning or controlling at least 25 percent of the Ownership Interest of the Reporting Company.

[iii] Pooled Investment Vehicle Exemption – (i) Any investment company, as defined in section 3(a) of the Investment Company Act of 1940 (15 U.S.C. 80a–3(a)); or (ii) any company that would be an investment company under that section but for the exclusion provided from that definition by paragraph (1) or (7) of section 3(c) of that Act (15 U.S.C. 80a-3(c)); and is identified by its legal name by the applicable investment adviser in the Form ADV (or successor form) filed with the U.S. Securities and Exchange Commission.

[iv] Subsidiary of Certain Exempt Entities Exemption – Any entity whose Ownership Interests are controlled or wholly owned, directly or indirectly, by one or more exempt entities: SEC Reporting Issuer; Government Authority; Bank; Credit Union; Depository Institution Holding Company; Broker or Dealer In Securities; Securities Exchange or Clearing Agency; Other Exchange Act Registered Entity; Investment Company or Investment Adviser; Venture Capital Fund Adviser; Insurance Company; State-licensed Insurance Producer; Commodity Exchange Act Registered Entity; Accounting Firm; Public Utility; Financial Market Utility; Tax-exempt Entity; or Large Operating Company.

[v] Beneficial Owner – see point ii.

[vi] Pooled Investment Vehicle Exemption – see point iii.

[vii] Foreign Pooled Investment Vehicle – A foreign legal entity that is formed under the laws of a foreign country, and that would be a Reporting Company but for the Pooled Investment Vehicle Exemption in 31 CFR 1010.380(c)(2)(xviii), must report to FinCEN the BOI of the individual who exercises Substantial Control over the legal entity. If more than one individual exercises Substantial Control over the entity, the entity shall report information with respect to the individual who has the greatest authority over the strategic management of the entity.

[viii] Special Reporting Rule - Foreign Pooled Investment Vehicle: They do not need to report information about each Beneficial Owner and Company Applicant if the company was formed under the laws of a foreign country and would be a Reporting Company if not for the pooled investment vehicle exemption. If this special rule applies, the entity must report one individual who exercises Substantial Control over the company. The entity does not need to report any Company Applicants. If more than one individual exercise Substantial Control over the company, the entity must report information about the individual who has the greatest authority over the strategic management of the company.

[ix] Reporting Company – Domestic Reporting Company: any domestic entity created by the filing of a document with a secretary of state or any similar office under the law of a state or Indian tribe and does not qualify for an exemption. Foreign Reporting Company: any entity that is a corporation, limited liability company or other entity that is formed under the law of a foreign country and that is registered to do business in the US by the filing of a document with a secretary of state or equivalent office under the law of a state or Indian tribe and does not qualify for an exemption.

[x] BOI Report – see point i.

[xi] Substantial Control – Substantial control over a Reporting Company includes: (i) Service as a senior officer of the Reporting Company; (ii) Authority over the appointment or removal of any senior officer or a majority or dominant minority of the board of directors (or similar body); (iii) Direction, determination, or decision of, or substantial influence over, important matters affecting the Reporting Company, including but not limited to: (A) The nature, scope, and attributes of the business of the Reporting Company, including the sale, lease, mortgage, or other transfer of any principal assets of the Reporting Company; (B) The reorganization, dissolution, or merger of the Reporting Company; (C) Major expenditures or investments, issuances of any equity, incurrence of any significant debt, or approval of the operating budget of the Reporting Company; (D) The selection or termination of business lines or ventures, or geographic focus, of the Reporting Company; (E) Compensation schemes and incentive programs for senior officers; (F) The entry into or termination, or the fulfillment or non-fulfillment of significant contracts; and (G) Amendments of any substantial governance documents of the Reporting Company, including the articles of incorporation or similar formation documents, bylaws, and significant policies or procedures; and (iv) Any other form of Substantial Control over the Reporting Company.

[xii] Ownership Interest (A) Any equity, stock, or similar instrument, certificate of interest or participation in any profit sharing agreement, preorganization certificate or subscription, transferable share, voting trust certificate or certificate of deposit for an equity security, interest in a joint venture, or certificate of interest in a business trust, without regard to whether any such instrument is transferable, is classified as stock or anything similar, or represents voting or non-voting shares; (B) Any capital or profit interest in a limited liability company or partnership, including limited and general partnership interests; (C) Any proprietorship interest; (D) Any instrument convertible, with or without consideration, into any instrument described in paragraph (d)(3)(i)(A), (B), or (C) of 31 CRF Part 1010 – General Provisions, any future on any such instrument, or any warrant or right to purchase, sell, or subscribe to a share or interest described in paragraph (d)(3)(i)(A), (B), or (C) of 31 CRF Part 1010 – General Provisions, regardless of whether characterized as debt; or (E) Any put, call, straddle, or other option or privilege of buying or selling any of the items described in paragraph (d)(3)(i)(A), (B), (C), or (D) of 31 CRF Part 1010 – General Provisions without being bound to do so. (ii) An individual may directly or indirectly own or control an Ownership Interest of a Reporting Company through a variety of means, including but not limited to: (A) Joint ownership with one or more other persons of an undivided interest in such Ownership Interest; (B) Through control of such Ownership Interest owned by another individual; (C) With regard to a trust or similar arrangement that holds such Ownership Interest: (1) As a trustee of the trust or other individual (if any) with the authority to dispose of trust assets; (2) As a beneficiary who: (i) Is the sole permissible recipient of income and principal from the trust; or (ii) Has the right to demand a distribution of or withdraw substantially all of the assets from the trust; or (3) As a grantor or settlor who has the right to revoke the trust or otherwise withdraw the assets of the trust: (i) Through ownership or control of one or more intermediary entities, or ownership or control of the Ownership Interests of any such entities, that separately or collectively own or control Ownership Interests of the Reporting Company; or (ii) Through any other contract, arrangement, understanding, or relationship. (iii) In determining whether an individual owns or controls 25 percent of the Ownership Interests of a Reporting Company, the Ownership Interests of the Reporting Company shall include all Ownership Interests of any class or type, and the percentage of such Ownership Interests that an individual owns or controls shall be determined by aggregating all of the individual’s Ownership Interests in comparison to the undiluted Ownership Interests of the company.

[xiii] BOI Report – see point i.

[xiv] BOI Report – see point i.

[xv] Reporting Company – see point ix.

[xvi] Reporting Company – see point ix.

[xvii] BOI Report – see point i.

[xviii] Substantial Control - See point xvi.

[xix] Ownership Interest - See point xii.

[xx] Reporting Company – see point ix.

[xxi] BOI Report – see point i.

[xxii] Special Reporting Rules – Entities Owned by Exempt Entity: They do not need to report information about any Beneficial Owner whose Ownership Interests in a Reporting Company are held through one or more entities, all of which are themselves exempt from the Reporting Company definition. If this special rule applies, then the Reporting Company may report the names of all of the exempt entities instead of information about the individual who is a Beneficial Owner of the company through Ownership Interests in those exempt entities.

[xxiv] Large Operating Company Exemption – Any entity that: (A) Employs more than 20 full time employees in the United States, with "full time employee in the United States" having the meaning provided in 26 CFR 54.4980H-1(a) and 54.4980H-3, except that the term "United States" as used in 26 CFR 54.4980H-1(a) and 54.4980H-3 has the meaning provided in § 1010.100(hhh); (B) Has an operating presence at a physical office within the United States; and (C) Filed a Federal income tax or information return in the United States for the previous year demonstrating more than $5,000,000 in gross receipts or sales, as reported as gross receipts or sales (net of returns and allowances) on the entity's IRS Form 1120, consolidated IRS Form 1120, IRS Form 1120-S, IRS Form 1065, or other applicable IRS form, excluding gross receipts or sales from sources outside the United States, as determined under Federal income tax principles. For an entity that is part of an affiliated group of corporations within the meaning of 26 U.S.C. 1504 that filed a consolidated return, the applicable amount shall be the amount reported on the consolidated return for such group.

[xxv] Reporting Company – see point ix.