Analysis & Insights

Helping to Manage the Challenges of SFDR Article 8 and 9 Funds

21 Feb 2023

Funds designated as SFDR Article 8 or Article 9 funds (depending on their level of adherence to ESG investment principles) needed to comply with enhanced regulations, leaving some firms challenged. For their part, institutional investors needed to feel assured that their investments are meeting their set ESG mandates.

The challenges of keeping pace with evolving ESG fund regulation have been percolating for a while. Some fund managers spent 2022, including the December holiday season, grappling to be in compliance for the 1 January deadline. Certain funds found themselves having to downgrade from classification as an Article 9 fund to 8, or from Article 8 to Article 6 as ESMA expectations for Article 8 and 9 funds became clearer ahead of the implementation deadline. Indeed, during the last few months of 2022, many of the world's leading asset management firms shed their ESG labels for less-stringent categories, accounting for more than $140 billion in assets under management.

Backtracking on set standards can mean an uncomfortable conversation with investors. No asset management firm wants to be in that situation. Fortunately, there are tools and mechanisms in place to position fund managers in ESG compliance and that can play an integral role in sustaining a green portfolio to meet the highest ESG regulatory standards. Your fund's credentials will remain intact and your investors will continue to rely on your brand to generate quality ESG investment returns.

Article 8 and 9 Funds Operating in Ireland

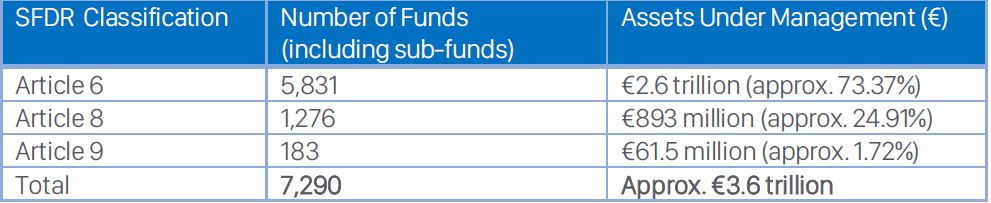

Source: Central Bank of Ireland1

ESG-compliant funds are now a solid fixture of the European asset management landscape and a requirement from many European investors. Take Ireland, for example: Statistics from the Central Bank of Ireland show that of the €3.6 trillion in assets held by SFDR-compliant funds, one quarter of that amount were categorised as Article 8 or 9 with only 1.72% of those assets reaching the criteria for Article 9.

Many funds lowered their Article 8 or 9 designations in Q4 2022 out of uncertainty of their compliance with SFDR. As the requirements to meet Article 8 and 9 classification became clearer, in many cases, managers realised that they had underestimated the time, expertise and resource required to comply in advance of 1 January. In essence, managers and funds were faced with an array of challenges including:

1) ESG Advisory: Article 8 and 9 requirements have evolved with the introduction of SFDR Level II and the various regulatory guidance papers issued throughout 2022. Managers struggled with the piecemeal implementation of SFDR and Taxonomy and the lack of clear and actionable guidance and advice on if and how they could adhere to the requirements of the regulation for their specific fund.

2) ESG Fund Management and Verification: Many managers and in particular non-EU based managers did not have a thorough understanding of the operational requirements for an SFDR Article 8 or 9 fund or have the appropriate operational framework and service providers in place to support such funds. In particular, managers and Boards were and continue to seek to implement leading ESG practice and service providers for ESG fund management, fund distribution and fund operations; as well as independent verification of a fund’s adherence to SFDR and ESG principles.

3) ESG Reporting: Another challenge encountered by managers is if and how to implement reporting as it relates to principal adverse impact indicators (PAIs) outlined by the SFDR regulation. For managers intending to report in 2023, it will be important to ensure that they can access and store the requisite ESG data to comply with the reporting requirements.

How Maples can help with Article 8 and 9 Funds

To assist with these challenges, and to provide the requisite expertise, time and resource, the Maples Group has an innovative and extensive ESG product offering to facilitate compliance with SFDR Articles 8 and 9.ESG Advisory

Maples Group has a dedicated, multi-disciplinary team of ESG and sustainable finance experts drawn from our global Banking, Finance, Corporate, Funds & Investment Management, Dispute Resolution & Insolvency, Projects & Construction, Property, Tax and Regulatory & Financial Services Advisory teams. Our multi-jurisdictional capabilities ensure that we have exposure to global ESG trends and sustainable finance developments. Our global footprint also enables us to draw on the experiences and expertise of the entire Maples Group to develop a uniform and consistent approach to ESG initiatives for our global clients. Maples' follow-the-sun model means our staff has had exposure across jurisdictions and has coverage across time zones to ensure timely and informed advice on all matters ESG.Our services include:

- Sustainable Finance: Advisory services and acting on behalf of investors, borrowers and lenders on ESG and sustainability-linked ESG lending transactions;

- EU Sustainable Funds and Taxonomy: guidance for funds on all steps of EU SFDR & Taxonomy compliance;

- Greenwashing Litigation and Advisory: legal advisory services on mitigation of greenwashing risk and regulatory missteps, including potential sanctions for greenwashing; and

- Corporate ESG and Good Governance: guiding companies and shareholders on an array of ESG-related topics and concerns.

ESG Fund Management

The Maples Group has also brought forth the Maples ESG Platform, an Irish Collective Asset Management Vehicle ("ICAV"). The Maples ESG Platform, registered with the Central Bank of Ireland and a Qualifying Investor Alternative Investment Fund, is an umbrella fund designed to offer clients a ready-made solution for SFDR fund management, compliance, distribution and operation of sustainability-themed funds. The Maples ESG Platform is managed and promoted by MPMF Fund Management (Ireland) Limited ("MPMF"), the Maples Group's Central Bank of Ireland-authorised alternative investment fund manager.

ESG Verification

The Group has also joined forces with top compliance and risk advisory firm K2 Integrity to give clients exclusive access to its independent certification process for ESG fund strategies. The certification takes a both qualitative and quantitative approach to ensure that the fund and the manager are in compliance with ESG best practices and industry standards. K2's proprietary framework encompasses regulatory assessments to enhance transparency and mitigate greenwashing.

ESG Data and Reporting Solutions

One pillar of the Maples Group's offering is the integration of a leading-edge ESG data and reporting system from Trucost, part of S&P Global. The system offers ESG reporting for both public and private investments, as well as offers regulatory reporting to meet requirements under SFDR.

Regulatory changes can bring about a sense of trepidation among fund managers wary of making missteps. Services such as top-quality ESG advisory, risk assessments, data reporting, and structured fund vehicles can help ensure your fund will remain on track to fulfilling both your ESG investment targets and the mandates for your institutional investor clients.

1Central Bank of Ireland, Sustainable Finance and the Asset Management Sector, November 2022.